EV charging stations: more plugs, standardized pricing, and reliability rises a little.

The whole topic of charging an electric vehicle remains a mystery to EV-curious car shoppers. Dealership sales staff often know little more than their customers. YouTube videos with horror stories about dead public charging stations, long lines, and slow charging—not to mention outright misinformation—don’t help.

But a new report from data analytics firm Paren, looking at data on EV charging sites from the first quarter of this year, suggests the public-charging picture is slowly improving. Called the State of the Industry Report: U.S. EV Fast Charging — Q1 2025, it’s the first of what the company says will be a regular quarterly series of reports on EV charging as it evolves.

Paren says it sees 2024 as “a year of mixed news in the US DC fast charging (DCFC) industry”, but that “we believe that it will be remembered as a pivotal turn to a new era known as ‘Charging 2.0.’“

The report offers the following trends and data.

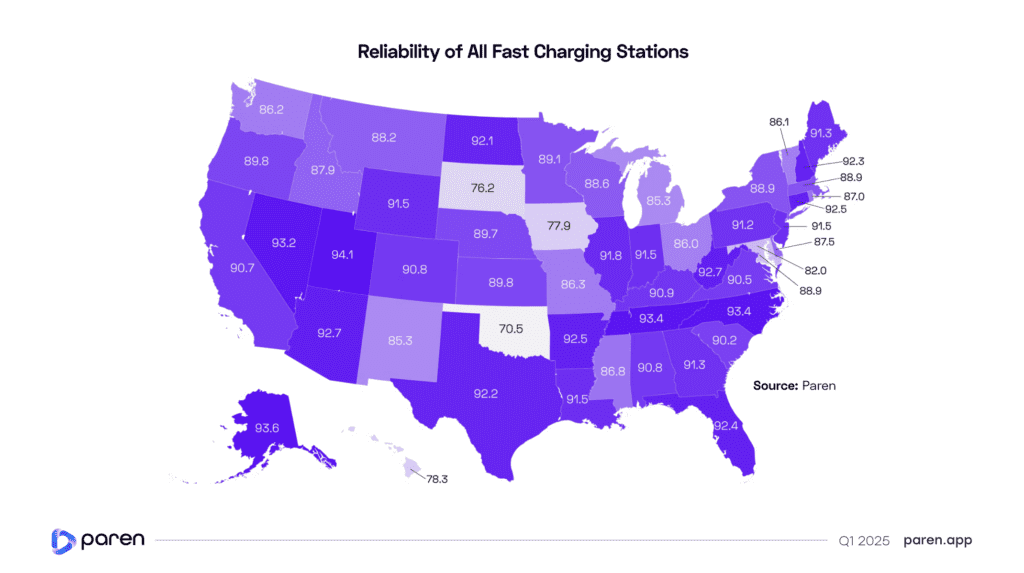

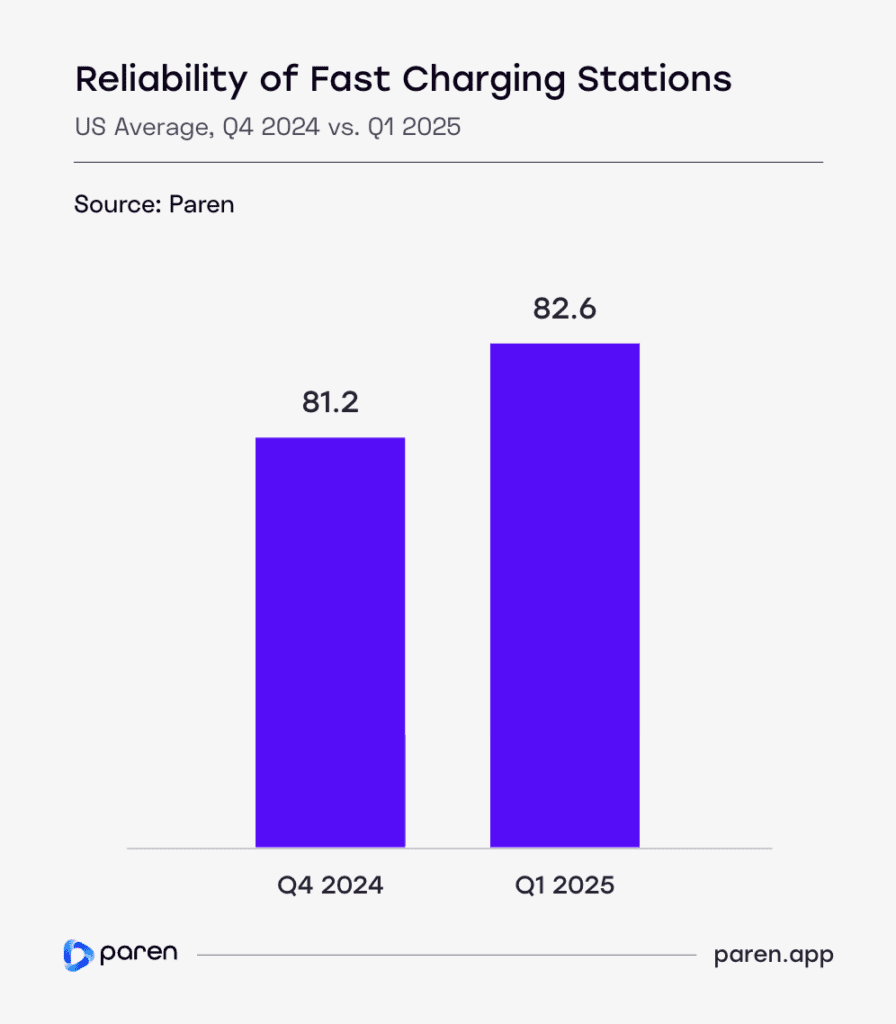

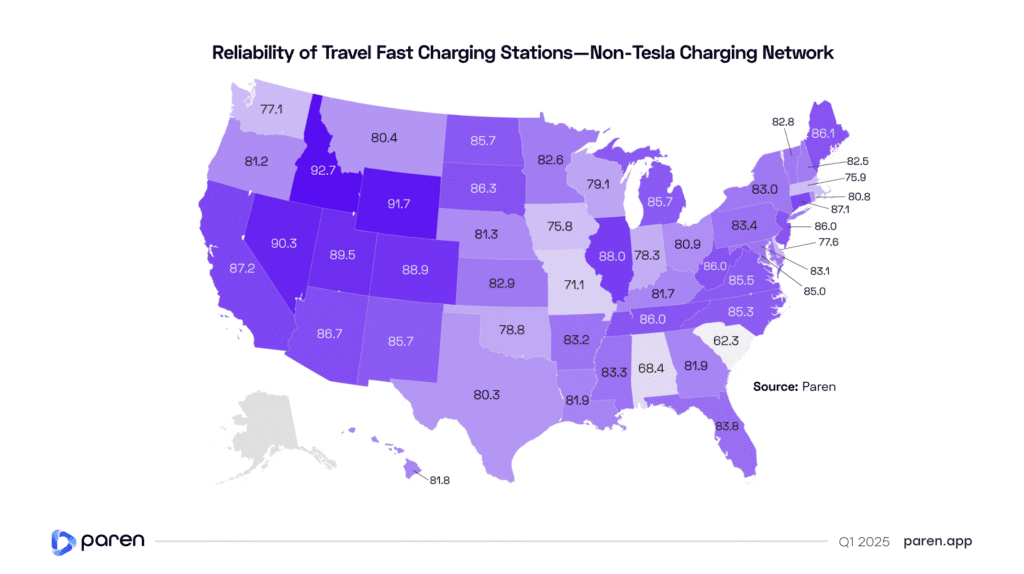

RELIABILITY RISES, SLOWLY: The firm’s U.S. Reliability Index for non-Tesla charging stations rose to 82.6 points for Q1 vs 81.2 points for Q4-2024. While 2 percent is hardly staggering, it likely means one or two more sessions out of every hundred will actually result in a charged EV. Among the causes: older hardware has been replaced or decommissioned, boosting uptime. And newer entrants into the field—including Ionna—now opt for proven hardware with known reliability.

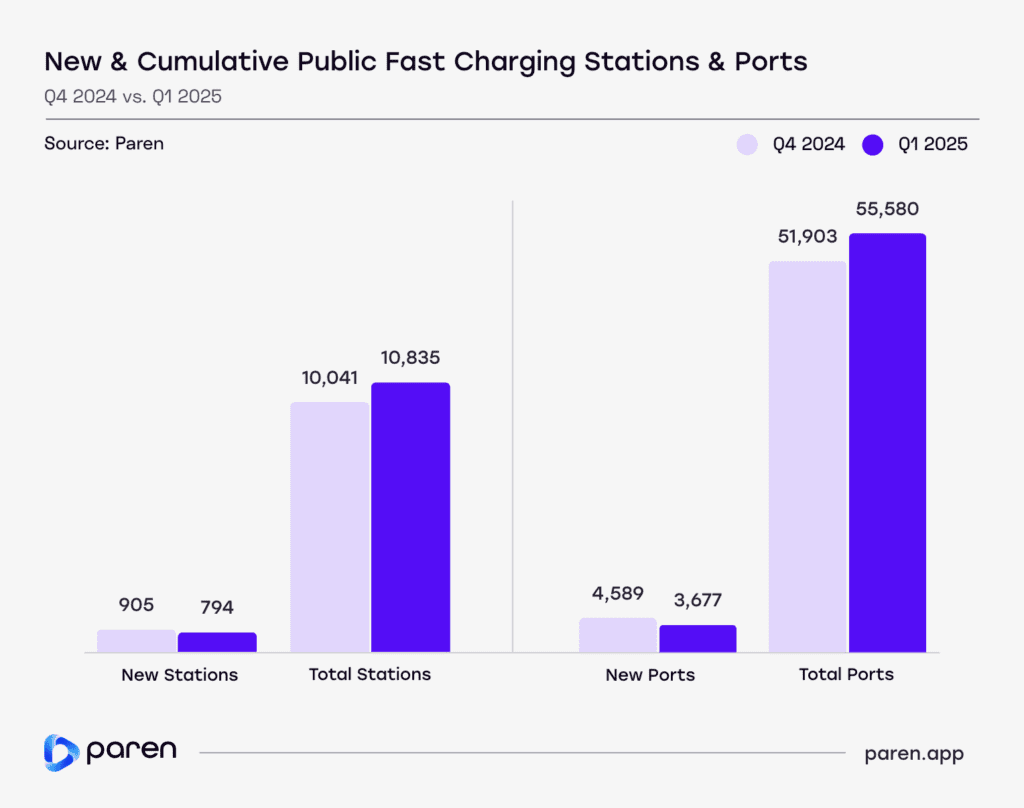

PORTS, SITES BOTH INCREASE: The number of U.S. (non-Tesla) ports, or charging cables, totaled 55,580 at the end of Q1, an increase of 3,667. The total number of sites (or stations) grew to 10,839, an increase of 794. While that’s fewer than were added in the prior quarter, Paren notes this is an expected seasonal effect due to winter weather slowing Q1 construction—as well as a year-end rush to open new sites by the end of 2024.

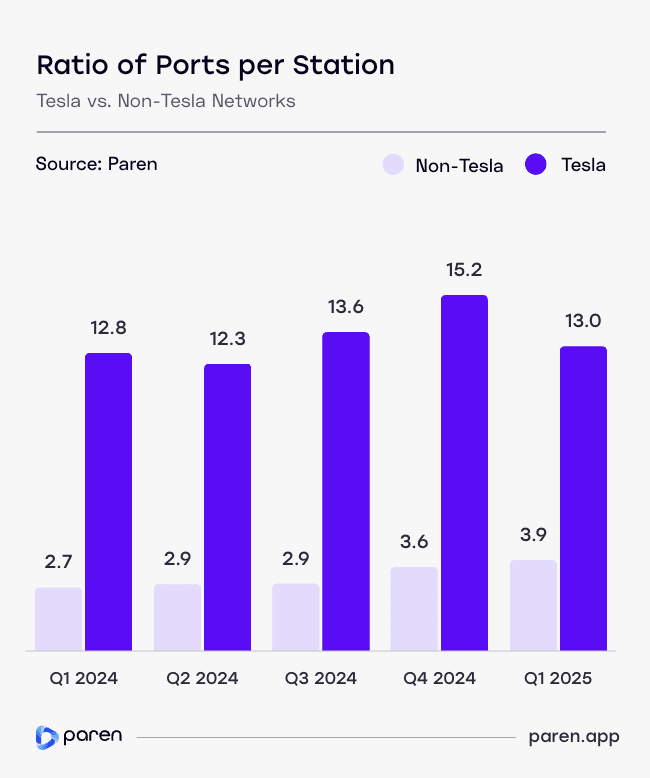

MORE CABLES PER SITE: Tesla has always had the highest number of cables at its Supercharger sites: 13.0 per station, per the most recent data. But the number is rising among non-Tesla networks too, with a healthy jump to 3.9 from 2.7 a year ago. Note the National Electric Vehicle Infrastructure (NEVI) program mandates at least four ports per station.

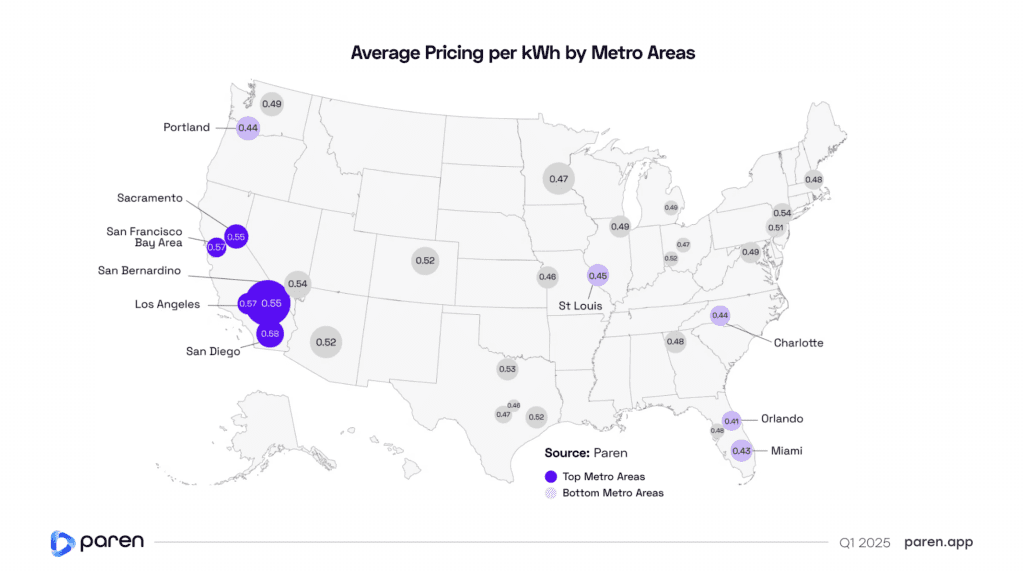

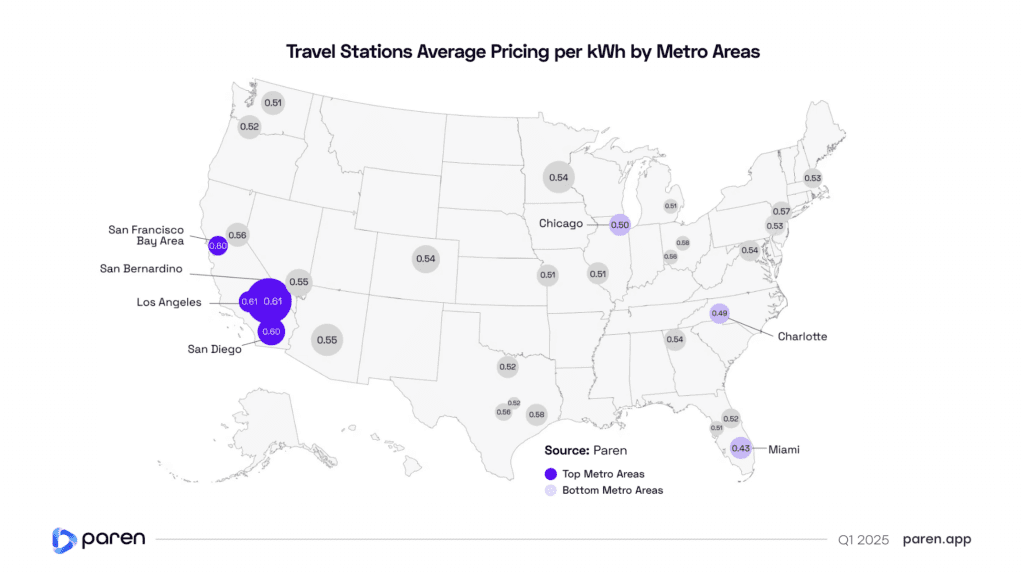

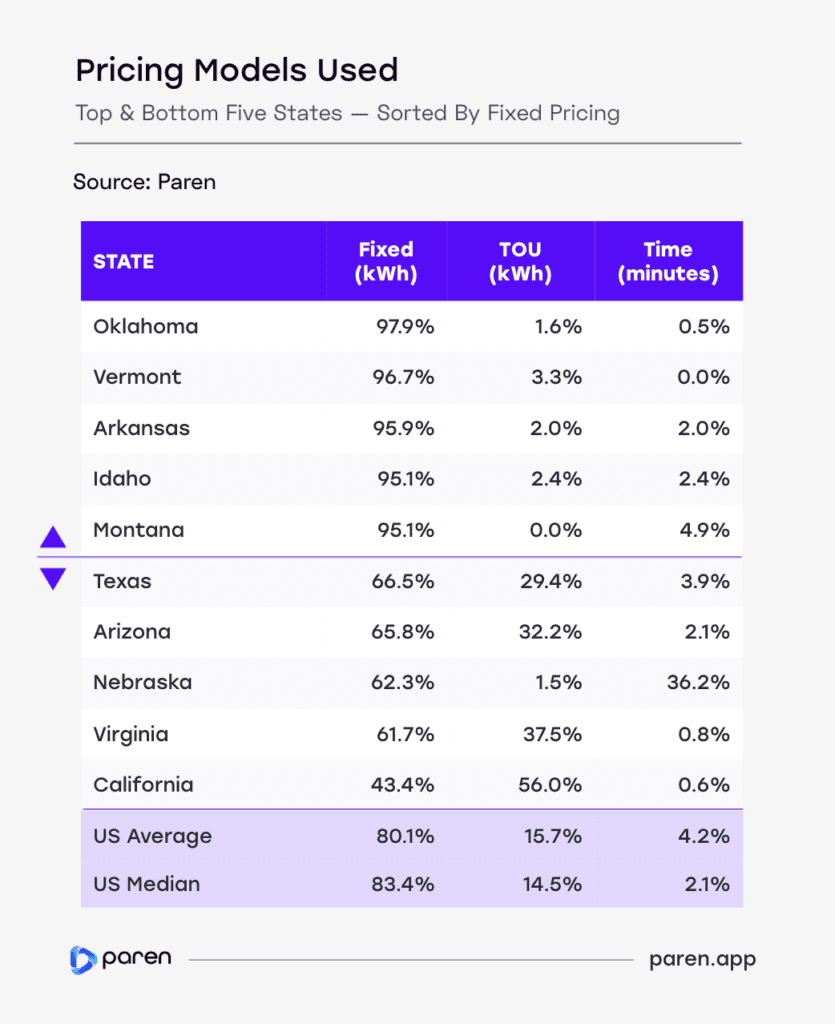

PRICING by kWh NOW STANDARD: Back in September 2020, when Electrify America moved to pricing by the kilowatt-hour (where allowed), EV drivers faced a confusing array of pricing structures at EV charging stations in different states. Now, however, EV drivers pay for fully 80 percent of their public charging sessions by the kWh. Those per-kWh prices may vary with the time of day for another 16 percent, but just 4 percent of sessions are now charged by time spent plugged in (whether by the minute or hour).

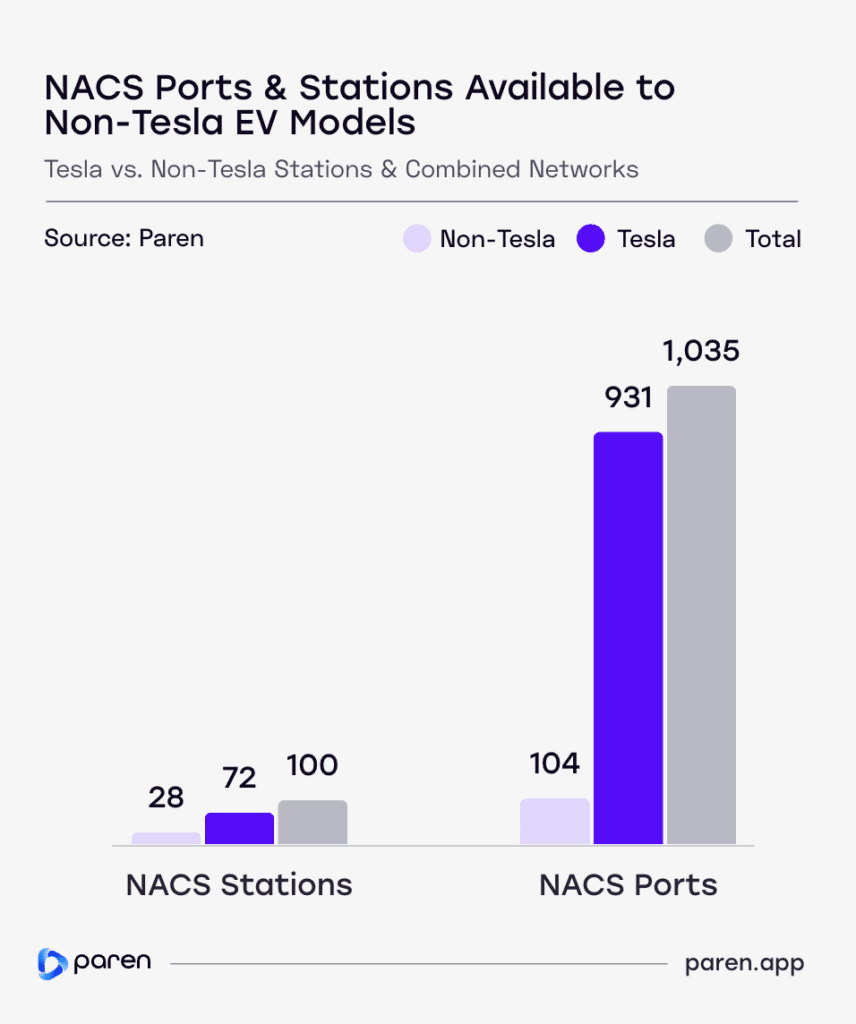

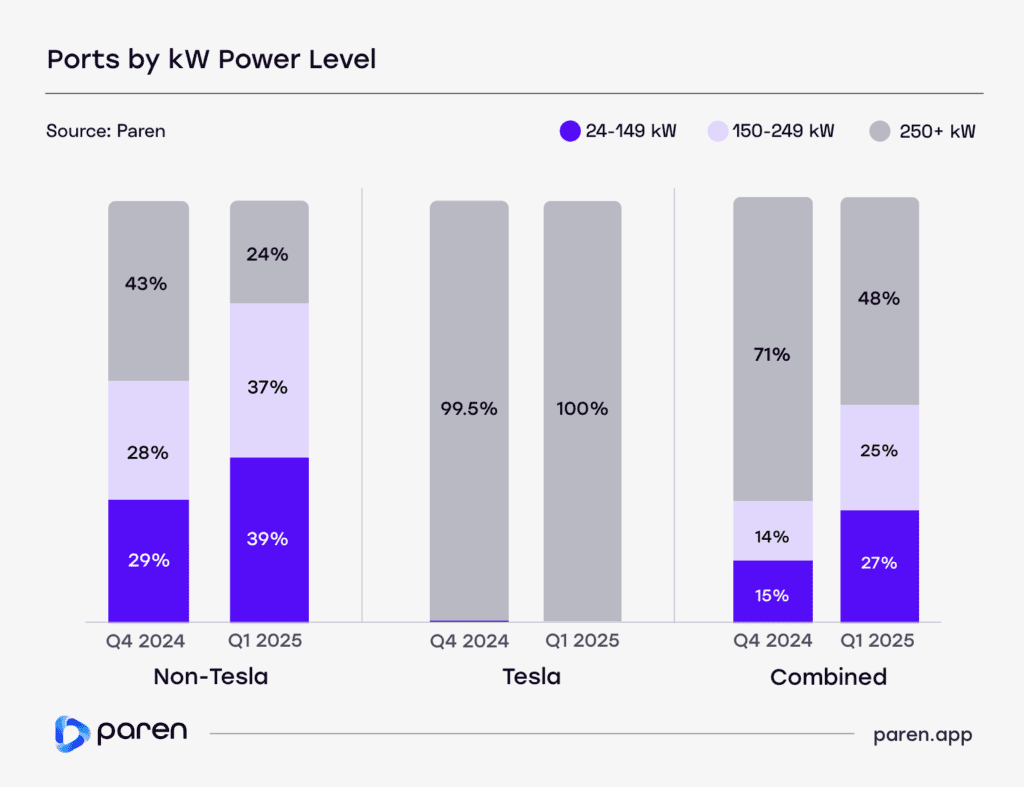

NACS TRANSITION STILL TO COME: Non-Tesla EVs with NACS charging ports are now appearing at dealers, e.g. U.S.-built 2025 Hyundai Ioniq 5. On the charging side, 59 percent of new ports in Q1 were CCS-enabled, 31 percent used a NACS connector, and 10 percent were (still!) CHAdeMO. But only 104 new NACS charging ports were installed outside Tesla’s Supercharger network, meaning we’re still in the early stages of the years-long transition to the J3400 connector standard. Drivers of those early NACS-equipped non-Tesla cars will likely have to rely on CCS-to-NACS adapters for a while.

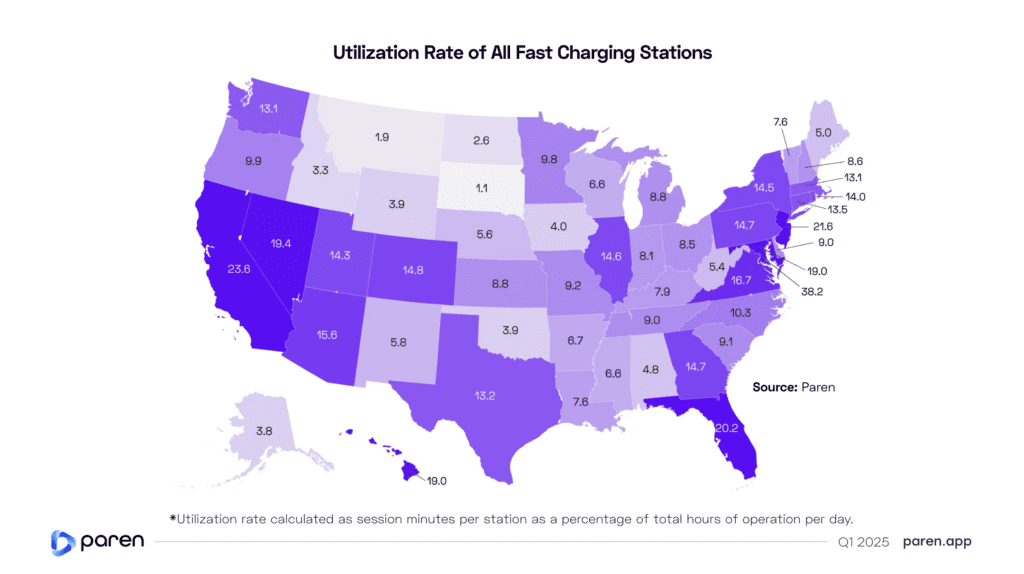

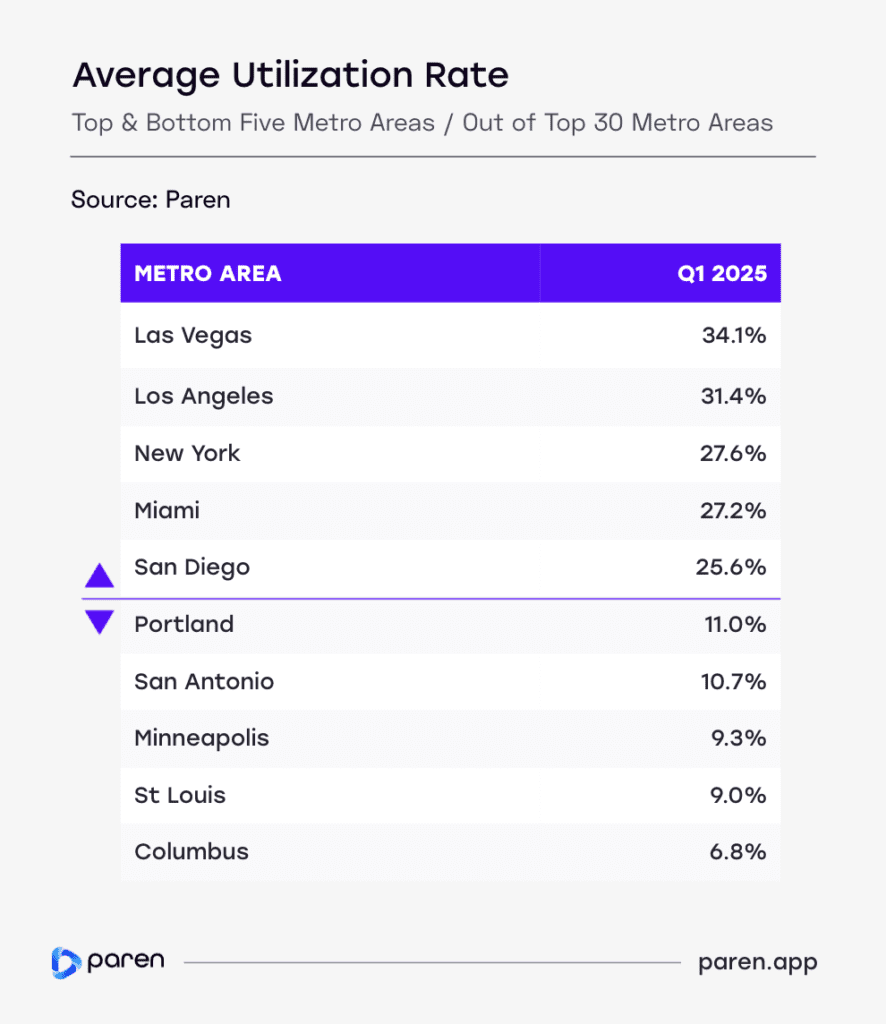

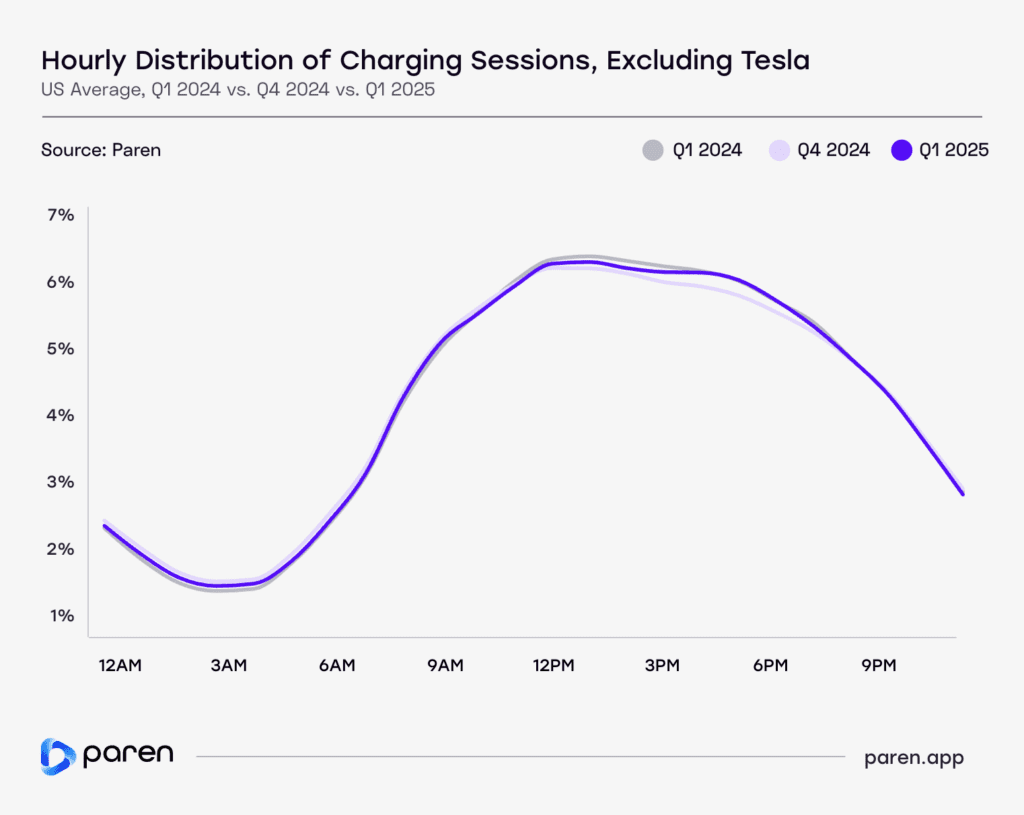

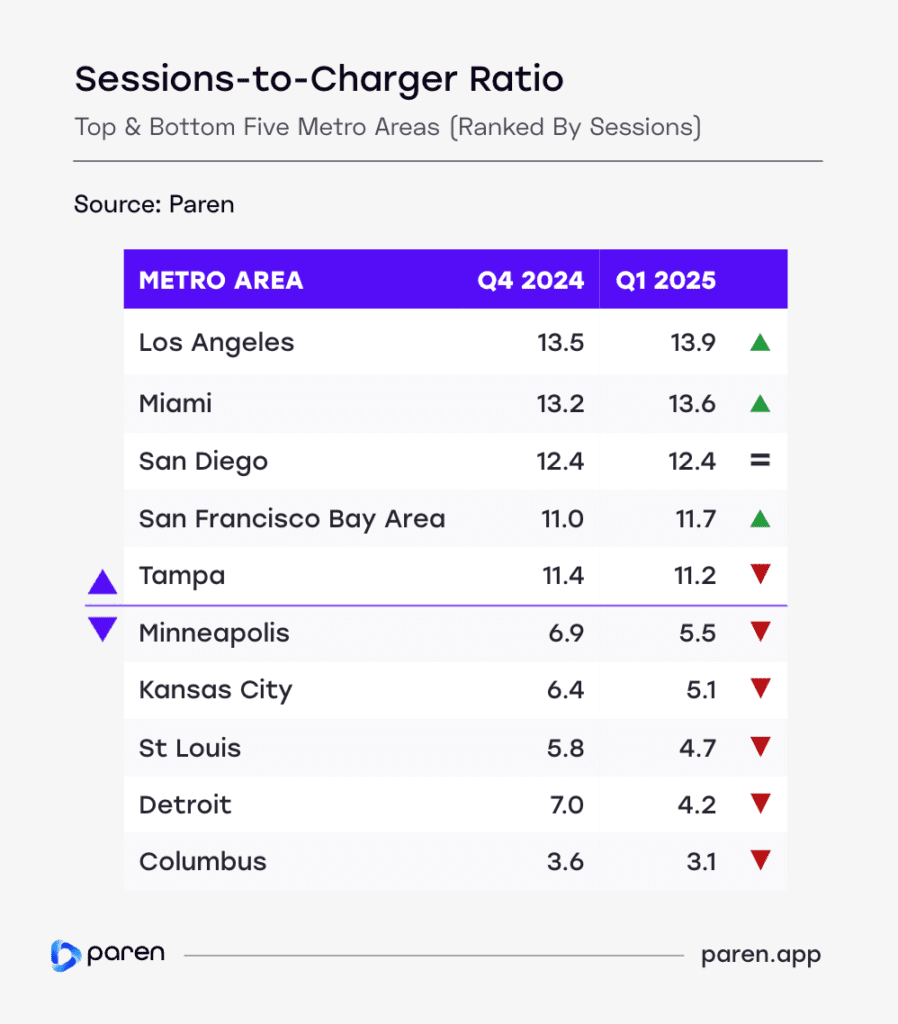

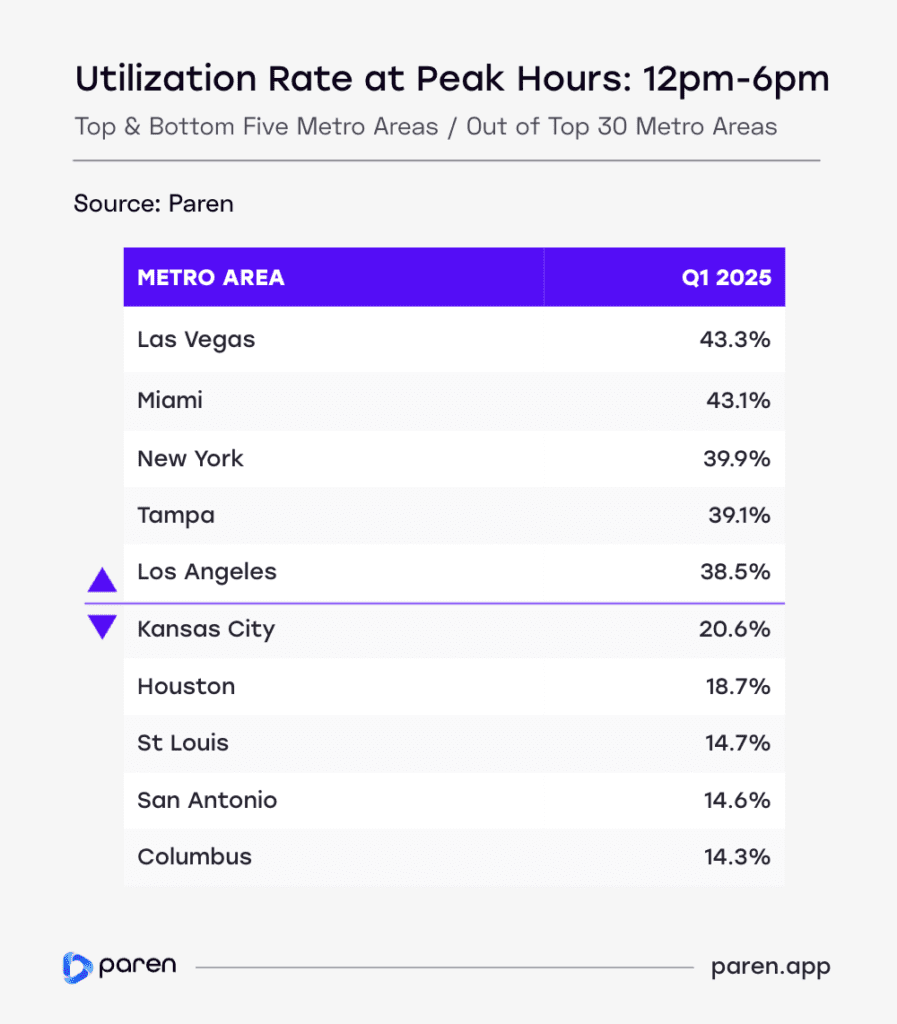

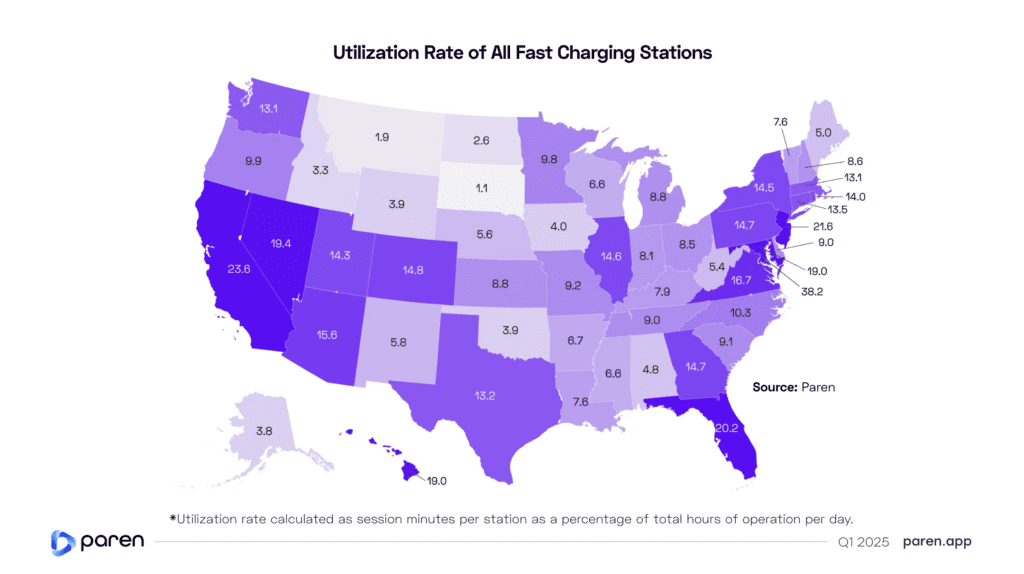

UTILIZATION RATES KEY: Most EV charging networks today lose money, because they’ve built out infrastructure on the promise of future traffic in years to come. Only higher utilization (the amount of time a station is actually charging an EV and earning money) can change that equation. While utilization is trending up, especially in dense urban coastal markets with lots of EVs and high proportions of both EV rideshare users and apartment renters who depend on public charging, the path is lumpy. Utilization rates in Q1 fell slightly to 16.2 percent from 16.6 percent in Q4 2024. Paren suggests the decline is a result of the typical Q4 bump from more EV travel during Thanksgiving and Christmas holidays.

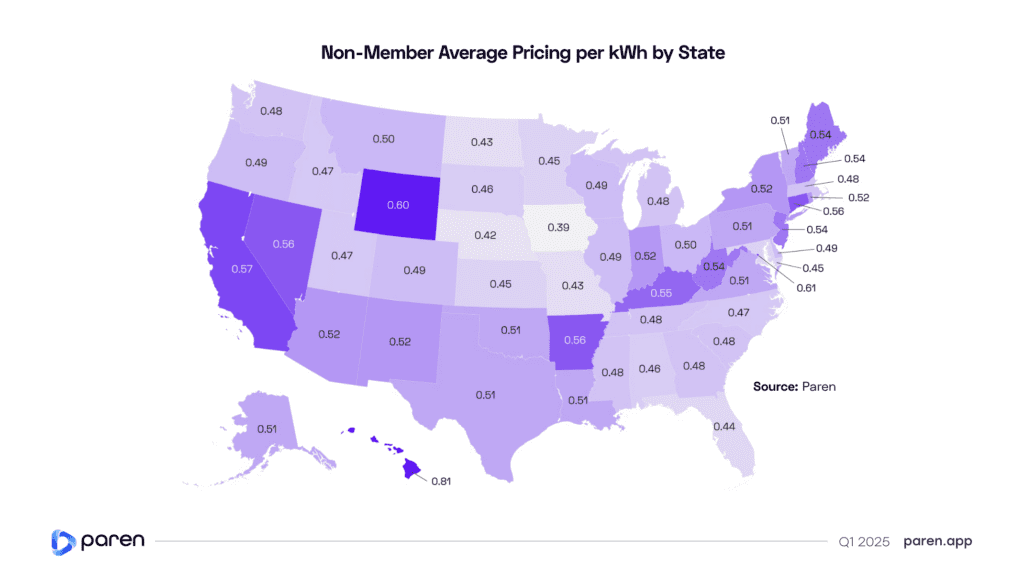

HINTERLANDS LEFT BEHIND? The now-paused National Electric Vehicle Infrastructure (NEVI) program was designed specifically to fund charging infrastructure in rural and low-income communities where for-profit charging networks typically don’t build new charging stations. “Our data is a harbinger of less expansion in rural and lower-income markets,” said Loren McDonald, chief analyst at Paren. Charging networks “will increasingly focus on urban markets seeing high utilization, often north of 30 percent, versus markets with less than 5 percent utilization.”

The granular data offered in Paren’s various charts and tables offers a few gems for the detail-obsessed EV observer. One example is the state of Florida. Despite its current governor’s often-expressed disdain for electric cars and anything involving EV charging—especially the NEVI program, which it has declined to distribute—the state recorded the fourth-highest rate of charger utilization in the country.

The report joins a handful of other analyses of EV public charging, but its quarterly nature suggests it could become a reliable bellwether for the state of charging in these evolving times. Its creator, Paren, says it “aggregates, enriches, and serves the most comprehensive data on the essential aspects of EV charging.” The full 28-page report can be downloaded via this link.